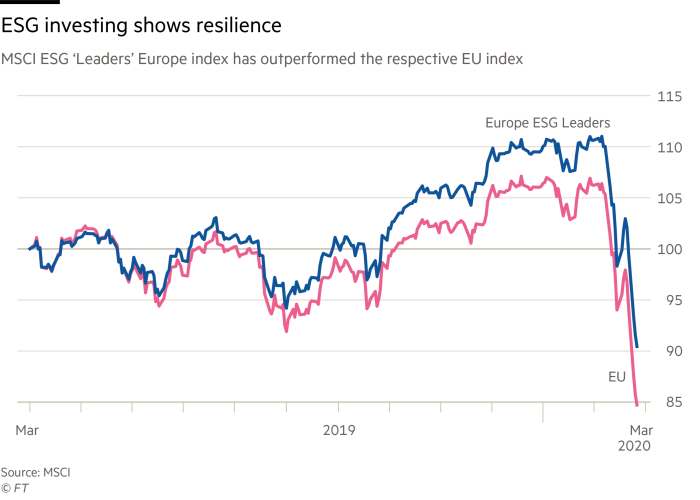

ESG Stocks have shown resilience through COVID’s economic shutdown.

Montreal,

Sept 09th, 2020

Environmental, Social, Governance investing has been growing steadily in recent years but has taken on the spotlight as the world rebounds from the impacts of COVID’s economic shutdown. ESG stock fell at a slower rate to traditional portfolios and have seen more resilience in recent months.

By investing in ESG-stock, we are investing in good business practices, which will ultimately help to shape our future.

Sustainable investing has been mounting in popularity for years. This new investment strategy took a radical leap forward this year with CEO of Blackrock, Larry Fink’s announcement that the $6.47tn asset manager’s “conviction is that sustainability- and climate-integrated portfolios can provide better risk-adjusted returns to investors”, and that the Blackrock fund managers would be conscious of businesses’ environmental and social responsibility going forward. Months later, this assertion was put to the test.

Though the pandemic was reported on haphazardly earlier this year, Larry Fink’s address made no mention of COVID-19. This pandemic, however, has been a perfect test of the strength of ESG stock portfolios. Over the course of the past months in quarantine, economic decline, political and trade instability, ESG-consideration stock have proven more robust than their non-ESG competitors.

Why have ESG-consideration stock shown more resilience to economic and social crises? Because the companies making up these portfolios have planned for such crises. They have financial reserves to keep the lights on through a financial crisis, they have secure supply chains with ethical and/or trusted and dedicated partners, they trade with companies who follow similar values as their own.

These things, when combined, mean that a company is able to keep running, it has the capacity and bandwidth to explore alternate revenue streams, supply chains, distribution channels, and support mechanisms through the crisis. It keeps its employees working, which means it’s supporting the maintenance of its ecosystem and economic structures, as well.

Companies are increasingly expected to do good with the revenues they earn from loyal customers. This means drawing from environmental, social, and governance considerations to maintain a strong, resilient, and powerful company even through a crisis. While environmental considerations look at the physical negative externalities of business activities, social considerations take into account the needs and security of the company’s workforce through an array of potential risk situations.

Governance takes on various meanings from decision-making to hierarchy and equity and inclusion within the company. One take on equitable governance through the pandemic has been lowering executive bonuses in order to keep staff on payroll. Demonstrating that executives are not sheltered from crisis can support corporate culture and increase employee confidence in their workplace. Other examples include redirecting funds from shareholders to PPE and non-critical functions, as well as redefining employee roles and reshaping company operating models to fit changing government regulations.

With this said, it is important to recognize that ESG funds tend to be leveraged towards companies with strong balance sheets and efficient supply chains and operations. These typically end up being companies with more resources at their disposal be it private investment, stronger networks, or competitive advantage in the marketplace.

Despite differences in size and investment at the moment, ESG-focused companies are here to stay and they’re on the rise. The Financial Times writes that a key reason for this is that, “the crisis has shone a spotlight on the role good businesses play in society.” By investing in ESG-stock, we are investing in good business practices, which will ultimately help to shape our future.